Many people assume that the price of gold is set by supply and demand. The idea is that there's something called the "gold market" where buyers and sellers of the metal transact to create the price you see on your screen.

That's not how it works.

Here's a quick overview of why the gold market was built to keep prices low … And how that system is failing.

Meet Paper Gold

Price discovery takes place mainly in “paper gold” markets, where futures and unallocated over-the-counter (OTC) contracts are traded. These instruments are promises of gold, not the metal itself. And promises of gold are nothing but words and numbers in electronic documents.

The result is a gold price created from a whirlwind of derivatives, reflecting the supply and demand for opaque credit instruments rather than physical metal.

The key instrument is XAUUSD, which turns gold into a currency pair, traded like EURUSD or GBPCHF. But gold is not like dollars, euros, British pounds or Swiss francs. As macro strategist Jim Bianco put it:

“We financialized gold. You can buy options. You can buy futures. You can buy ETFs. We turned gold into another fiat currency."

How We Got Here

Under the classical gold standard, currencies were legally defined as fixed weights of gold. That arrangement constrained governments’ ability to finance large-scale spending and to wage war. The system was suspended during World War I, when warring states issued new currency units to cover vast military costs.

To stabilise the international financial system, the UK and US convened a conference in Genoa in 1922. At it, they persuaded other countries to use sterling and dollars as reserves and to treat these banknotes as if "good as gold."

This began a slow transition away from gold as the anchor of the financial system — and ended 49 years later with the Nixon shock of 1971.

Hold it Down

Many goldbugs suspect that individual dealers or rogue traders suppress the price day to day. That happens, but is not how the gold market is manipulated.

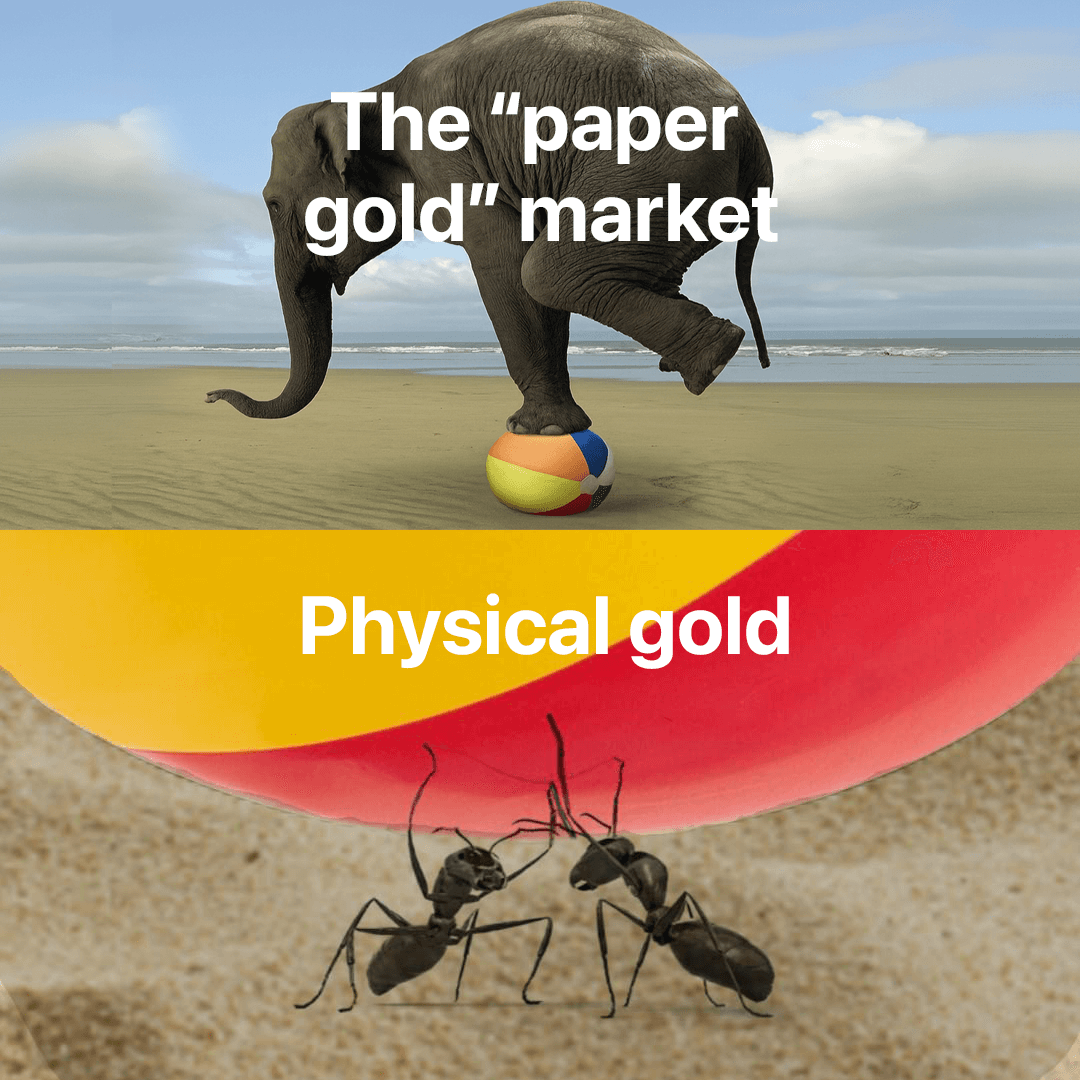

The suppression is structural. Price discovery happens mostly in derivative markets, where paper contracts are created in volumes far larger than physical bullion. The result is an oversupply of “paper gold” that caps the price.

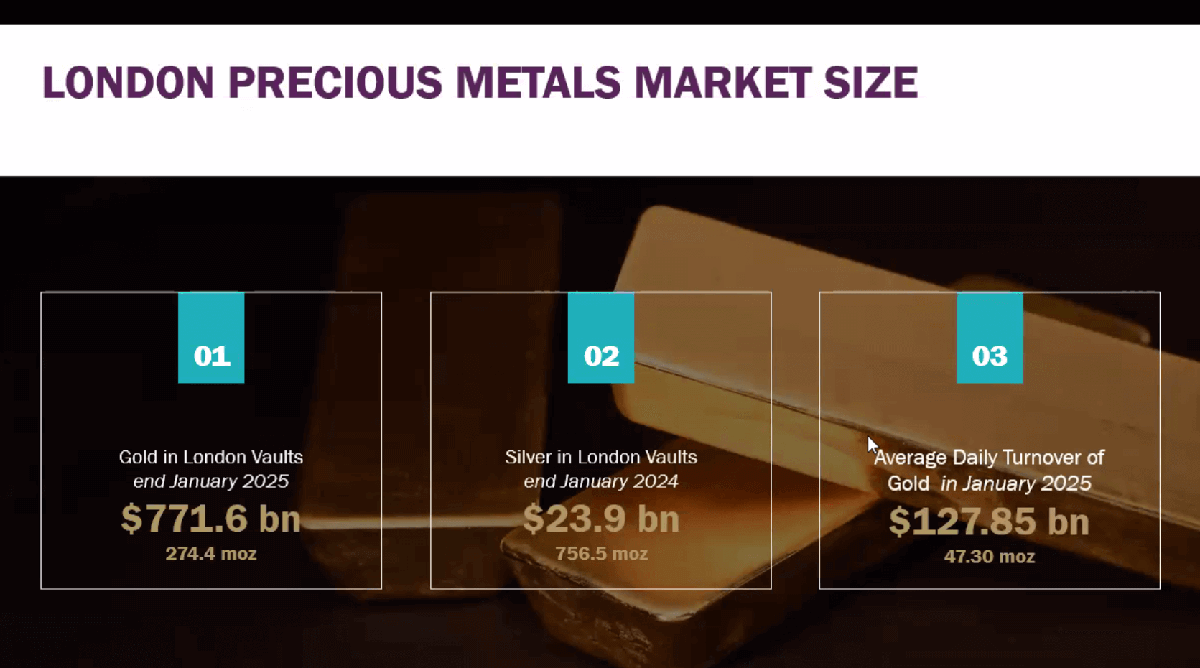

This slide from a London Bullion Market Association (LBMA) presentation in January 2025 shows the scale:

- ~1,471 tonnes average daily turnover in the London OTC market (January 2025, LBMA)

- ~8,535 tonnes vaulted in London at end-January 2025 (LBMA)

From here the leverage depends on how you count it, and that depends on who really owns the vaulted gold. The London market makes this deliberately opaque, so I speculate:

Including ETF bars, the effective float is about 3,000 tonnes, which implies leverage near 120 to 1. Excluding ETF bars, the float shrinks to 1,500–2,000 tonnes, which implies leverage of 180 to 240 to 1. About 5,000–6,000 tonnes sit in the Bank of England’s vaults for central banks, ring-fenced from the tradable pool. The remainder, roughly 3,400 tonnes in commercial vaults, covers ETF and ETC holdings (GLD, PHAU, SGLN), private allocations, and dealer inventory.

A grey zone lies in ETF/ETC (exchange-traded fund/commodity) holdings. These funds hold physical bars that are supposed to be ring-fenced for investors, but they are controlled by the same banks that dominate pricing. Many suspect bars have been double-counted, leased, or even sold into the market.

Understand GLD

FOFOA has a good explanation for how gold ETFs like GLD differ from owning physical bullion:

- Imagine a coat check room. You hand in your coat, get a claim ticket, and after the show you redeem your coat with that ticket.

- GLD shares are like coat check tickets, each one meant to represent a fraction of the gold held for customers.

But there’s a catch.

- Only large institutions, called Authorized Participants (APs), can redeem their tickets for gold—and only in huge lots, about a third of a ton.

- Smaller investors can only trade tickets or cash out. They never get a coat back.

That makes GLD a synthetic substitute, not ownership of bullion. FOFOA warns that in a real crisis, GLD holders may be “cashed out at the most recent official price” while physical gold soars.

The coat room does not need to have all the coats, and the rules may change so only insiders can redeem. Would you leave your coat in a coat check room set up to give banks control of all the coats?

The system layers vast paper claims on top of relatively little metal. Each ounce of physical gold supports hundreds of paper ounces. LBMA data shows London trading can average a thousand tonnes of paper gold a day. With global mine output around 3,600 tonnes a year, even a few days of London trading exceed the world’s annual supply of new gold.

Divert demand

Since World War II, US Treasury paper has served as the world’s reserve asset. Gold, by contrast, is finite, neutral, and beyond the control of any government. But sustaining an empire is costly, so rival monetary anchors had to be neutralised. One method was to suppress gold in order to keep demand for Treasuries strong, a strategy set in motion during the 1970s.

When gold rises, Treasuries look weaker as a reserve asset. Suppressing gold props up Treasuries.

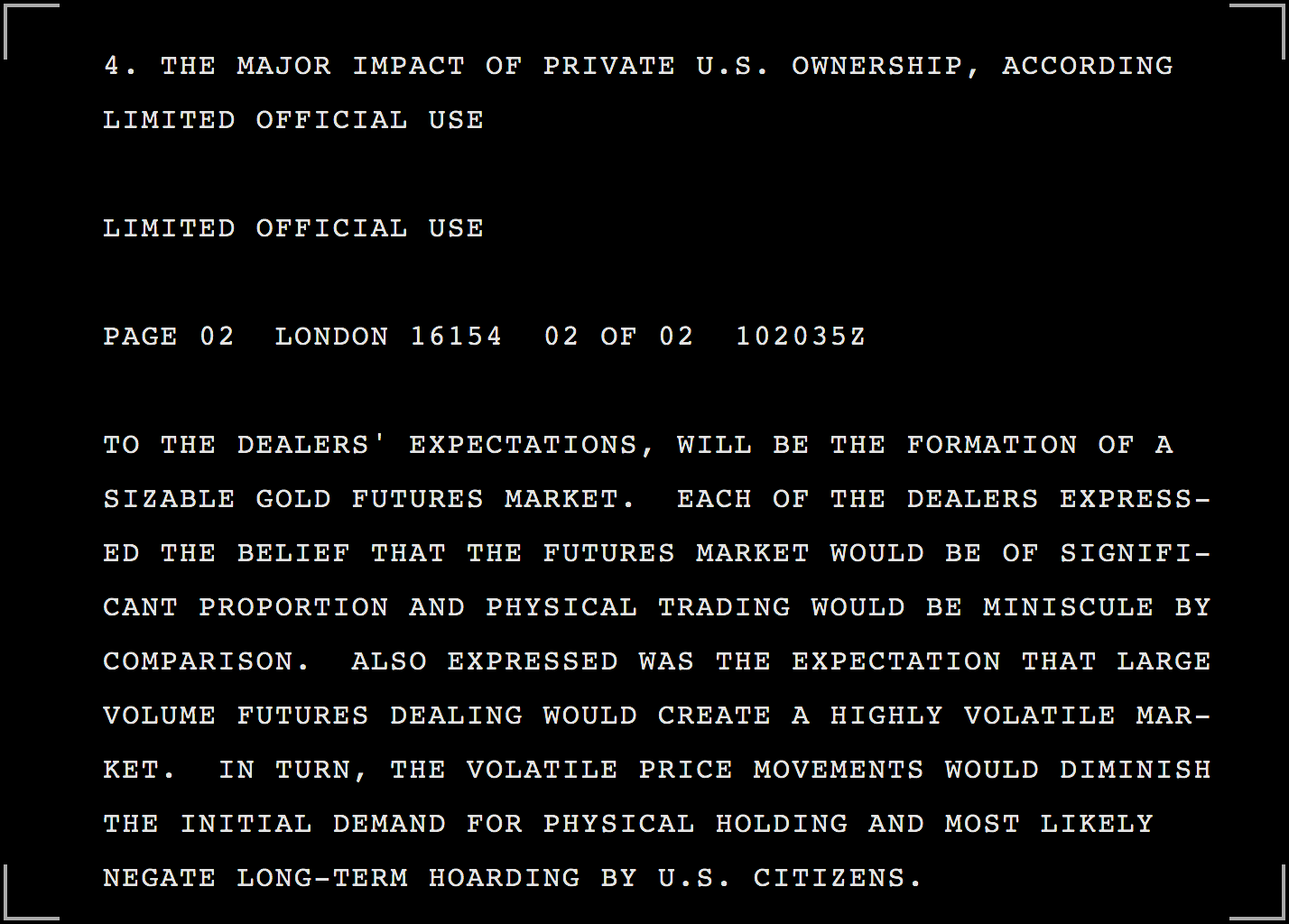

A leaked US State Dept cable from 1974 shows that Washington understood exactly how a gold futures market could be used to suppress demand for physical metal. The cable records London dealers outlining what they expected futures trading in gold to achieve. Namely, the creation of a gold futures market would be a great way to divert demand away from the physical metal:

A debt-based system relies on ever more promises. Paper gold is one of its pillars. Every contract is a claim on metal that may or may not exist. When confidence breaks and people see the promises cannot be kept, the system collapses.

Break Promises

Gold is making new highs every week, and this is another signal of stress deep in the financial system.

The dollar-based paper gold regime has let the US and Britain live beyond their means for decades, but that arrangement is failing. Too many promises have been made.

Non-Western nations now have fewer reasons to accept:

- London and New York setting the gold price for their own political ends

- Symbolic currency tokens as payment for resources and manufactured goods

So China is leading the rest of the world in building an alternative "physical only" gold market to bypass London and allow discovery of the true price of the metal without the tsunami of credit and derivatives that hide it. On the Shanghai Gold Exchange, contracts require delivery, unlike London’s unallocated system.

London remains the centre of global gold trading for now, but its grip is slipping. The shift to a physical-only gold market could be disastrous for the Western financial system.