I don't know anyone who is enthusiastic about Europe's future.

Humans are primates so focus blame on particular humans or groups for the failure of an entire system. This makes us murderous. You may have noticed those feelings within yourself.

But behind the decline and dread and revolutionary rage sits a slow-motion economic breakdown that's picking up speed.

The core problem is debt: states, banks, corporations and individuals have borrowed and lent far more than can ever be repaid. Admitting that will mark the bursting of the greatest debt superbubble in history.

Cash 4 Gold

The system that you see failing was born at the 1922 Genoa Conference, where the UK and US governments persuaded the world to accept their banknotes as substitutes for gold.

It was the original Cash 4 Gold scheme and started a 49-year process that removed gold from the centre of the global monetary system, ending with the Nixon Shock of 1971.

Genoa introduced a new "gold exchange standard." Central banks could still trade in gold, but ordinary Europeans were denied the practical ability to redeem banknotes for gold coins, as had been normal before World War One.

Instead, banknotes could only be redeemed for the new standardised form of gold:

The 400-troy-ounce “Good Delivery” bar: a long, golden brick weighing around 12.5 kilograms. Right now, my local gold dealer sells them for €1.49 million.

The 400-oz bar became the international standard for institutional gold storage. It's no accident that they are heavy, expensive and exclusive: they were designed to be traded and held by central banks and financial institutions only.

The institutionalisation of gold concentrated it in official vaults and kept it out of the hands of private investors and savers. Those investors were cattled into new financial instruments that banks and brokers were free to create in almost limitless amounts.

Other Anglospheric attempts to keep gold out of the hands of the people include:

- 1933: Executive Order 6102 forced US citizens to surrender most of their gold to the Federal Reserve, punishable by fine or imprisonment.

- 1959: the Australian Banking Act allowed the government to seize private gold and exchange it for its currency tokens.

- 1966: Britons were banned from owning more than four gold or silver coins, and private gold imports were blocked to protect the pound.

- 1970s: Washington and London backed the creation of a large gold futures market where trading in paper claims would dwarf physical demand. Price volatility in this futures market was expected to scare off small savers, reduce the desire to hold real metal, and stop long-term hoarding by U.S. citizens (more on that here).

Today, financial media in London and New York still run a consistent gold aversion training or unmarketing campaign against gold ownership, steering investors towards the paper and digital products that keep the bubble from bursting.

But the bubble is starting to burst.

Cash 4 gold shops stripped Western citizens of their jewellery, coins and small bars. The metal was shipped to Switzerland, melted down, recast into Asia’s preferred products, then sent further east to disappear into vaults. Maybe never to return.

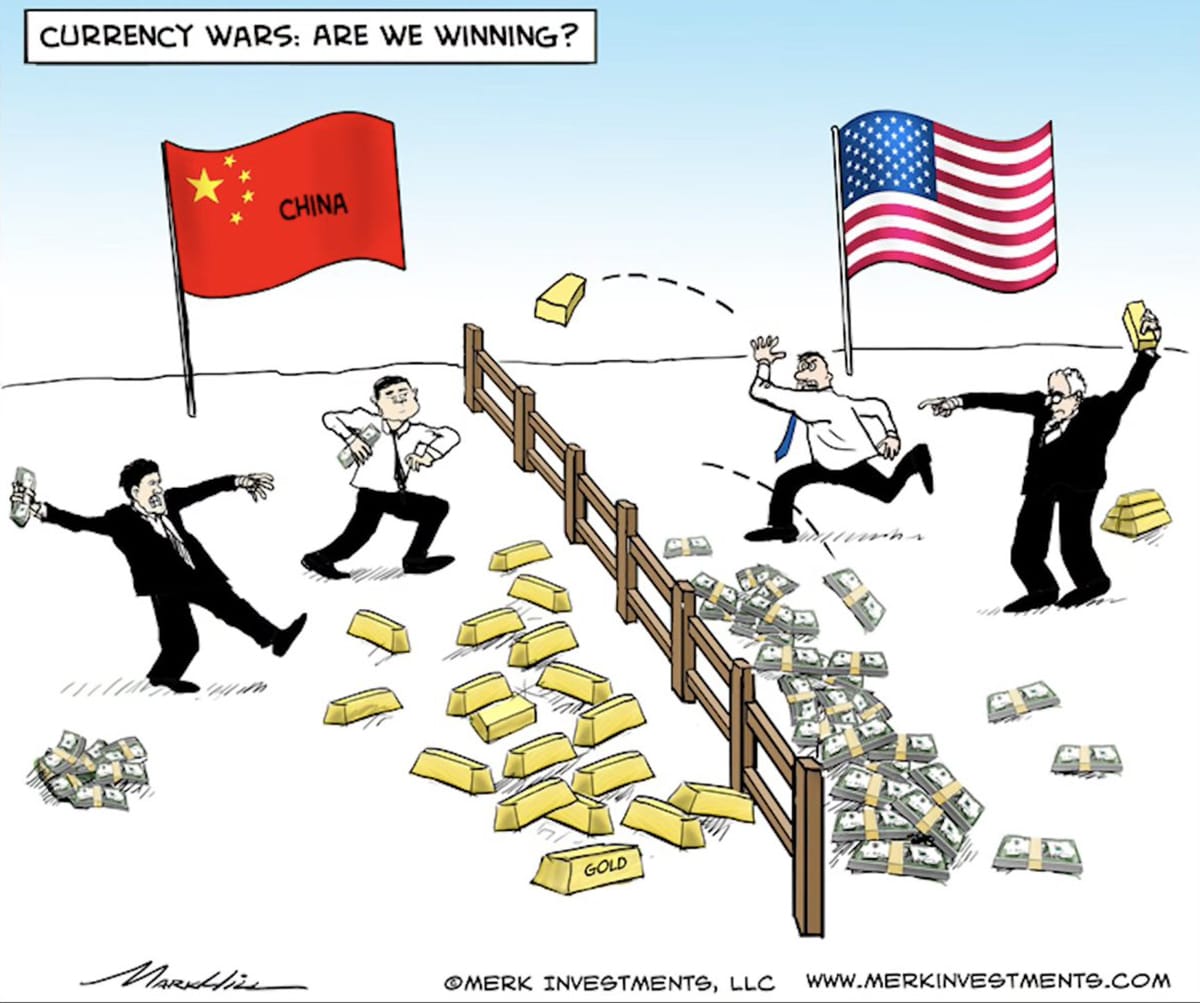

BRICS nations see gold as an ideal replacement for the US dollar, which is increasingly used as a weapon against America’s enemies and its friends.

While the West put gold with their elites, Eurasian powers are putting it with the people. That choice creates a fundamentally different, and far more resilient, society.

Democratise Gold

People in India have accumulated gold for thousands of years. Ownership runs deep in the culture through weddings, festivals and family savings. Indians may hold more than 27,000 tonnes of gold, far more than the combined reserves of the United States, Germany, Italy, France and the UK. This private accumulation makes India resilient to economic shocks and spreads wealth across society rather than concentrating it with banking elites.

In 2004, China formalised the same idea with a state program called “Storing Gold With the People” (让黄金回归人民). This policy is the direct opposite of the West’s: distribute gold among the people to make the nation wealthy. “Gold with the people” means encouraging households to buy and hold physical metal.

One mechanism is smaller bars. The shift is shown in the preference for 1-kilogram bars (around 32.15 oz). These are designed for smaller investors and companies rather than central banks and megabanks. They are far more manageable and accessible, but rising gold prices push them out of reach for many.

Higher prices actually make gold better at its main job: storing large amounts of value in a very small space. Rising prices create demand toward even smaller units as the metal does its job more efficiently.

The next key vehicle for the democratisation of finance will be the 1-gram bar.

If a poor Indian household can save for one gram at a time, I expect the Superbubble reader can do something similar. Over time this behaviour has distributed gold widely through Indian society. As gold is revalued upwards, India will suddenly become far richer than today’s stats suggest.

Getting physical is the Eastern solution to the Western debt crisis. I think they are winning.