In April 2025 President Trump sent a message:

The United States holds more than 8,000 tonnes of gold, the world's largest national reserve. USG also holds around 2,500 tonnes of European gold in its vaults. Most of this belongs to Germany, Italy, and the Netherlands, with Belgium and Austria having smaller holdings.

The exact numbers are not public. Some claim that the German gold was sold decades ago to prop up the dollar system. The German Bundesbank says the gold is still there, but has only verified the tiny samples USG allowed.

As the gold price neared $5,600 yesterday, the value of the European gold on US soil went over $450 billion. That's $64 billion more a week ago when gold was at $4,800.

The official story is that European gold was held in the US and UK to protect it from the Soviet Union. The reality is that supporting the dollar system (by not using gold in trade) was a pillar of Europe's post-WW2 subservience.

Since he was re-elected president, Trump has signalled intent to keep Europe’s gold. It would not be the first time. American governments have a history of taking other people's stuff. Two gold-related examples:

- 1933: The US government criminalised private gold ownership. They also ordered American citizens to sell their gold to the government at $20.67 per ounce. President Roosevelt then revalued gold to $35, transferring wealth from the people to the state.

- 1971: US President Nixon suspended convertibility of dollars into gold, defaulting on gold owed to European governments that held dollar reserves.

Retaliate First

In a recent Fox News interview, Trump was asked what he would do if the Europeans sold US Treasury holdings in retaliation for his tariffs. He answered:

"If they do, they do, but if that would happen, there would be a big retaliation on our part … And we have all the cards."

2500 tonnes of European gold in US vaults is a spectacular card. If/when confiscation happens, it need not be called theft.

In '71, Nixon made up a story about foreign speculators attacking the dollar. Trump can do better: Retaliation for Greenland, Ukraine, trade imbalances, or reparations for "defending" Europe.

Declaring yourself 'victim' can justify malevolence. And Trump regularly talks about Europe's unfair practices in trade, NATO and doling out peace prizes.

Blink First

Europe's leaders are uniformly weak. Trump seems to enjoy bullying them. Every week brings new humiliations and their weakness is exploited for American economic advantage.

This is not a just Donald Trump thing. He is simply continuing Biden's demolition of European economies.

- The policy was announced in 2023 when Biden's National Security adviser Jake Sullivan described a "high fence, small yard" approach to controlling friends and excluding enemies.

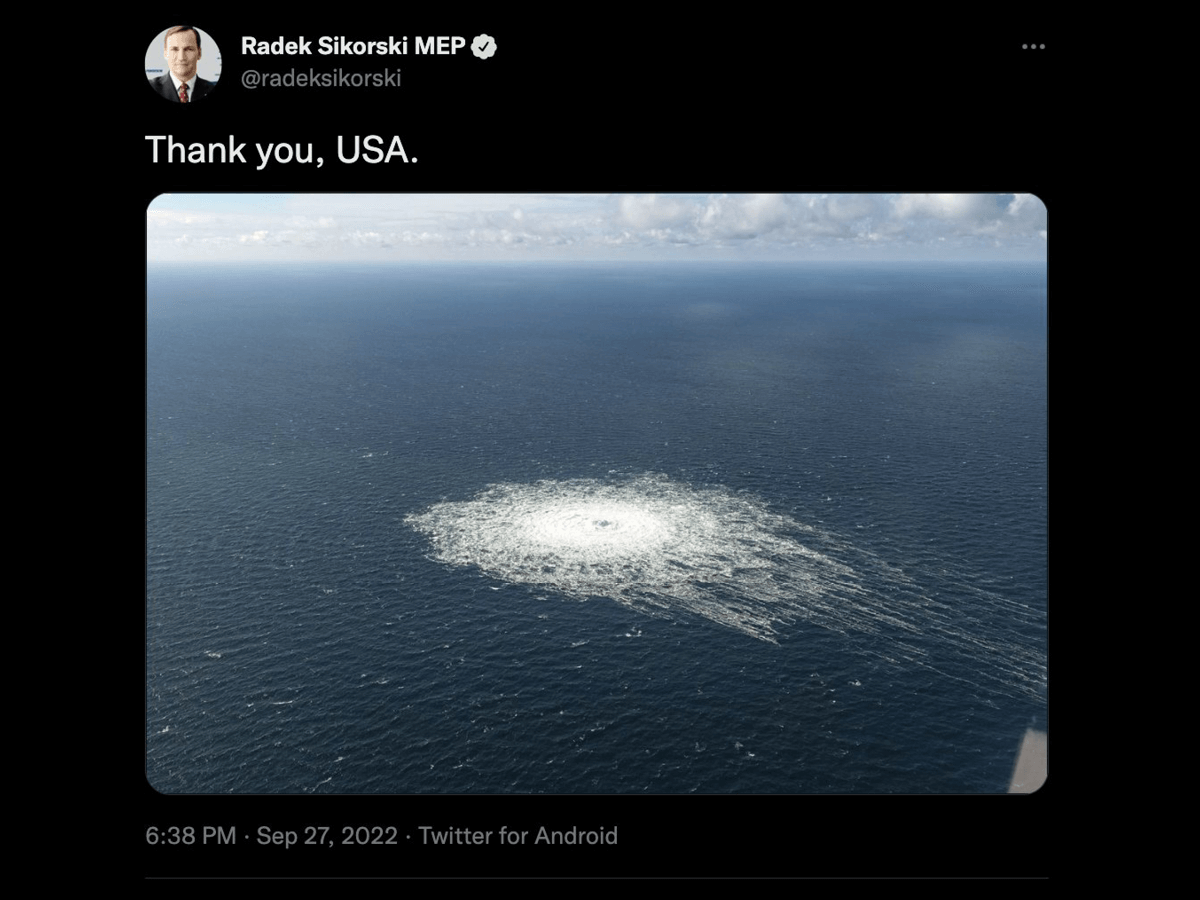

- In early 2022, Olaf Scholz stood passively beside Biden as Biden promised the Nord Stream 2 gas pipeline would not go ahead.

- Eight months later, three of the four Nord Stream pipelines were blown up. The Danish, Swedish and German governments politely refused to investigate properly.

Whatever crises are stoked in or near Europe, the response is the same: more European capital, resources, labour, and industrial capacity are flung into America’s debt maw.

The Ukraine war resulted in decades-long contracts where Europeans will buy overpriced US LNG (bringing deindustrialization) and obsolete US weapons (bringing military defeat, if it comes to that).

Don't Ask

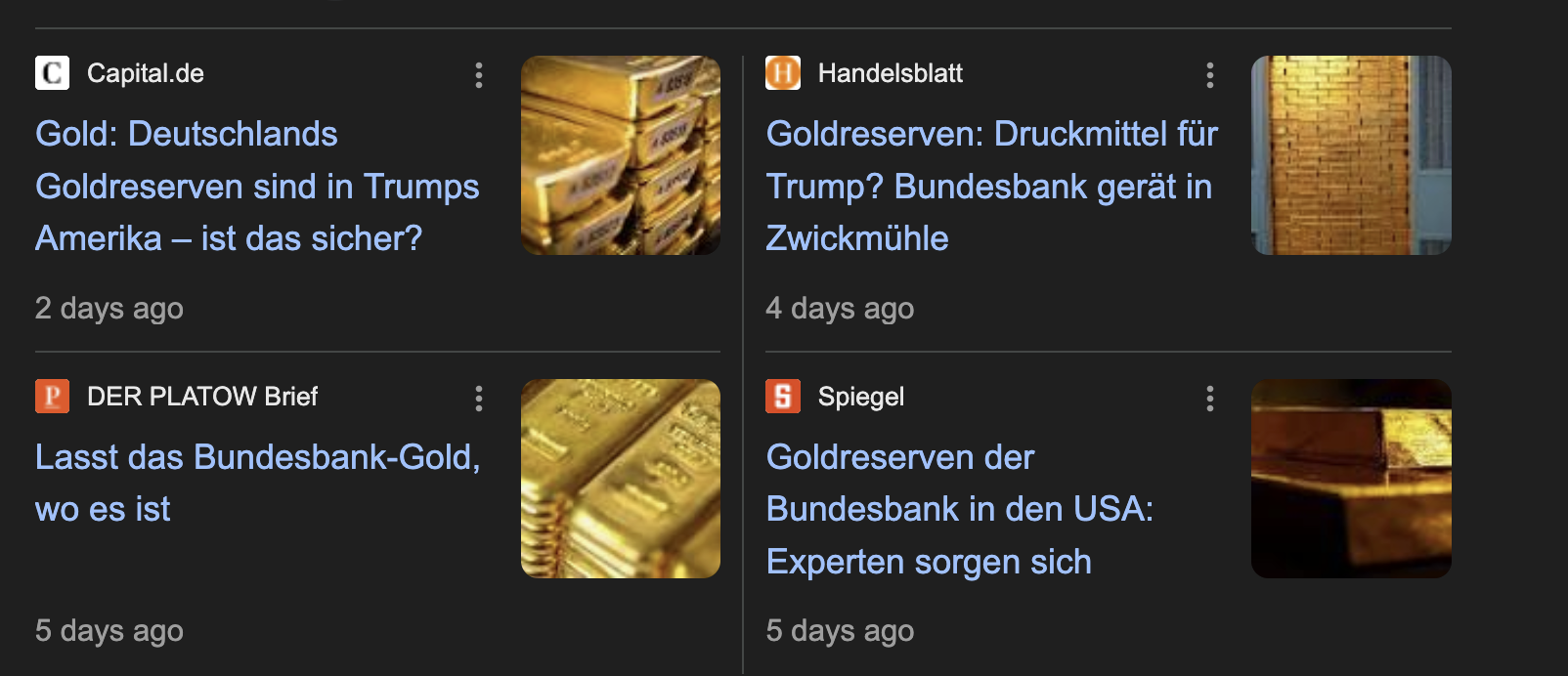

After the United States, Germany has the world's second largest gold reserves (3,352 tonnes). Of that, Germany claims to store 1,236 tonnes at the Federal Reserve Bank of New York.

At $5,500 per ounce, that is more than $220 billion.

Germany's economy is in sharp decline and needs investment. The Bundesbank, however, has rejected even the possibility of considering asking USG for their gold back.

Last week, German mainstream TV had debates on the issue:

Tagesshau / ARD

Tagesshau's first expert suggested Germany should think about asking for gold repatriation from the US. Clemens Fuest of the IFO got the last word:

"Now is the wrong time to bring the gold home. Because the Americans could understand this as an expression that we do not trust them. And since we are already arguing, this could add fuel to the fire and escalate this dispute. That is not in our interest."

Are we worms? Is two hundred and twenty billion dollars not worth offending the Orange One for?

With one tweet, Trump could humiliate Germany and reset America’s balance sheet on more favourable terms. Why would he not?

Ukraine and Greenland show what happens next. When Eurocrats are losing, they switch the no (or offered deals with bad conditions), they accept the frame and negotiate language details.

Expect to see Ursula, Mark, Kaja, Keir, Mette, Emmanuel, Friedrich, Antonio and maybe the other Antonio scuttling between Downing Street, the Élysée Palace and the Bundeskanzleramt.

Eventually they'll agree compromise wording on a joint communiqué about the need for shared values or unity or respect for sovereign property etc.

America will tell Europe to kick rocks, as the expression goes. Our officials will complain, loudly but anonymously, to politico.eu and other supportive sources.

But they are on shaky moral ground.

- In 2018, The UK seized around 31 tonnes of Venezuelan gold, worth roughly $6 billion, and still has not returned it.

- The EU froze more than €300 billion of Russian central bank assets and pushed for confiscation until Belgium and Hungary said no.

Since the end of WW2 the United States government has made the rules: Confiscation of other nations’ assets is okay when USG does it. Europeans accepted this, so will they be surprised when on the receiving end?

Turn Inward

European elites will make European citizens pay for their failures. That means turning their attention to assets inside Europe.

While Germany refuses to defend what is theirs, Ursula has proposed the Savings and Investments Union (SIU), a mechanism for pulling Europe’s €10 trillion in household savings into defence and “strategic” sectors.

The Netherlands has voted to tax unrealised gains on assets people haven’t sold. France is looking for ways to tax its citizens globally. Germany’s interior minister announced that when the origins of property are unclear, guilt will be assumed and owners must prove they committed no crimes.

Looting is legal when states do it.

For decades, institutions in London and New York have systematically steered investors away from physical metal and toward paper products that banks can create in unlimited quantities.

You have been trained to think gold is old-fashioned, risky, outdated, impractical. A useless relic. A “pet rock.”

This is unmarketing: Coordinated campaigns to keep the Western debt bubble inflated.

Trump will show Europe what their gold is worth by keeping it. We'll know its value when it's gone.