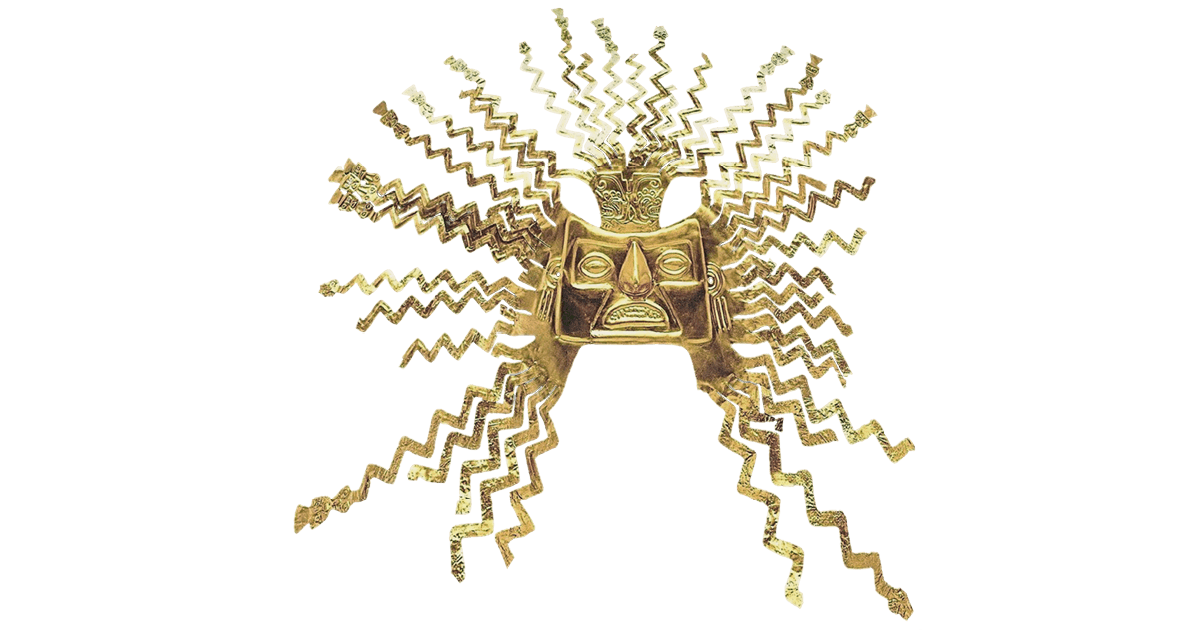

The Incas believed gold was the sweat of the Sun.

That sounded stupid until August 17, 2017, when astronomers detected two neutron stars colliding. Event GW170817 confirmed that most of the gold in the universe is created in kilonovas: when two neutron stars lock into a tight binary orbit and crash into each other.

Neutron stars are the collapsed remnants of supernovas. They are tiny and incredibly dense: a teaspoon of their matter would weigh billions of tons. When neutron stars collide and explode, vast amounts of gold, platinum, and other heavy elements are flung out into space

These elements form in milliseconds during the blast. Over billions of years, that material cools and condenses into clouds of gas and dust that form stars and planets. A minuscule fraction reached Earth.

Gold is unmistakably heavy in the hand.

That is because it contains a large number of protons (79) and neutrons (118) forced together in its nucleus. This requires extremely rare conditions, like neutron star mergers, which are estimated to occur roughly once every ten thousand years in a galaxy like ours.

Weight matters because physical systems stabilize around mass.

In 1543, Nicolaus Copernicus placed the Sun at the centre of the solar system, replacing the Earth-centred model. Since then, we have drawn the solar system as a simple diagram: a glowing Sun at the centre, planets orbiting in flat circles.

That picture isn't quite right. It omits the fact that the Sun is moving.

Source: @starwalkerapp

The Sun spirals around the Milky Way galaxy at 828,000 kilometres per hour. Eight planets and hundreds of moons spiral around the Sun. The Sun contains 99.8 percent of the solar system’s total mass. Its enormity creates a gravitational pull that has kept planetary orbits stable for almost five billion years.

Gold anchored monetary systems through the same mechanism: physical mass creates constraints that cannot be overcome by decree.

Set the Standard

No individual designed the classical gold standard. No committee decreed it. It evolved over centuries and converged on a simple rule: a banknote was a promise of a fixed weight of gold.

Gold’s role was not enforced by law or threat of violence. It came from collective belief in gold’s value to other humans. This is one of the few human beliefs that has remained constant across thousands of years.

The system worked because people trusted gold more than they trusted governments.

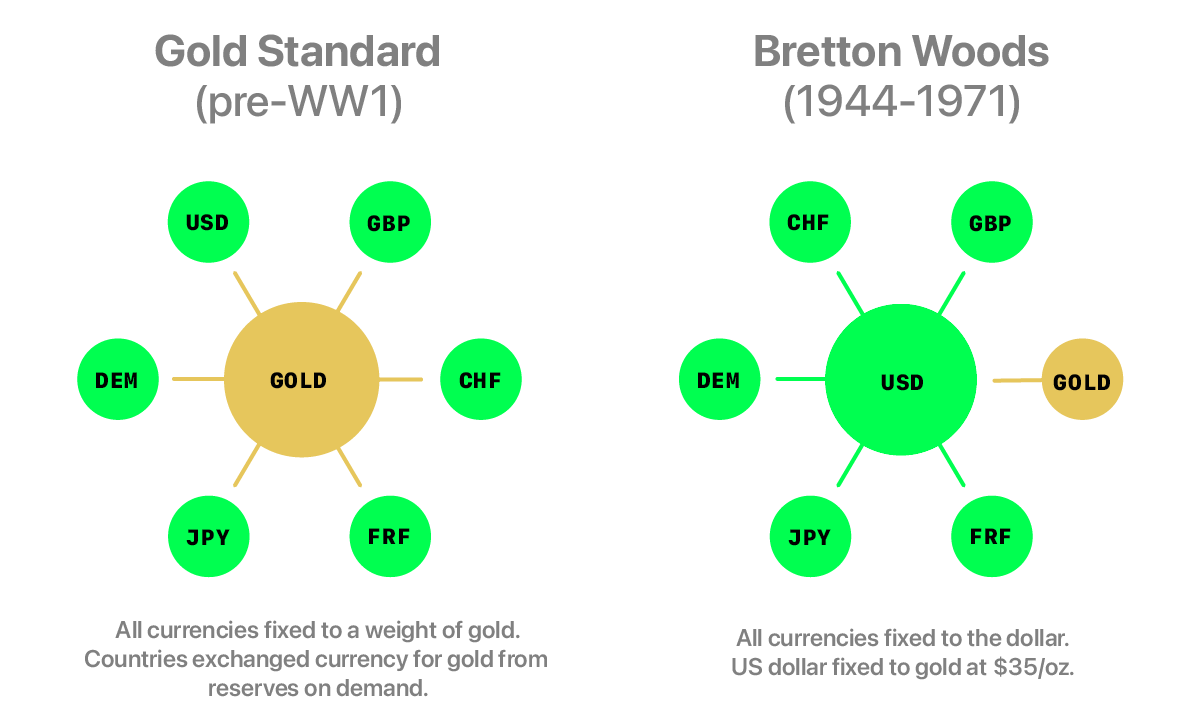

Jelle Zijlstra, who ran the Dutch central bank and later the Bank for International Settlements, described the system the same way. Gold functioned as the Sun. Currencies were the planets orbiting it.

Zijlstra explained:

“Throughout centuries gold was a protection against disasters, arbitrariness, and persecution. Because it does not rust and never perishes, gold developed its image of solidity, stability, and reliability.”

That stability was deliberately undermined in the twentieth century.

Unset the Standard

World War I

The classical gold standard lasted until 1914, when European governments abandoned convertibility to finance the First World War. Under gold, war was expensive. Under fiat money, war could be financed by printing currency units.

European elites broke the promise of the gold standard to wage a war that spiralled out of control and killed tens of millions of people, for reasons they could not explain.

In 1922, the Genoa Conference was convened to restore order. The UK and US imposed their solution: a gold exchange standard. Only the dollar and the British pound were convertible to gold. Other countries were persuaded to hold reserves in those currencies instead of gold itself.

World War II

After the second war, another conference was convened to rebuild the system. The Bretton Woods system placed the U.S. dollar at the centre of global finance. Other currencies orbited the dollar at fixed exchange rates.

The dollar, in theory, was convertible to gold at thirty-five dollars per ounce.

Zijlstra argued that removing gold from the centre unmoored the monetary order. It began to drift, and economist Robert Mundell described the resulting imbalance:

"Think of it like the solar system. It started with gold at the centre, as the Sun, but then Jupiter got bigger and bigger until all the planets started circulating Jupiter instead."

The Nixon Shock

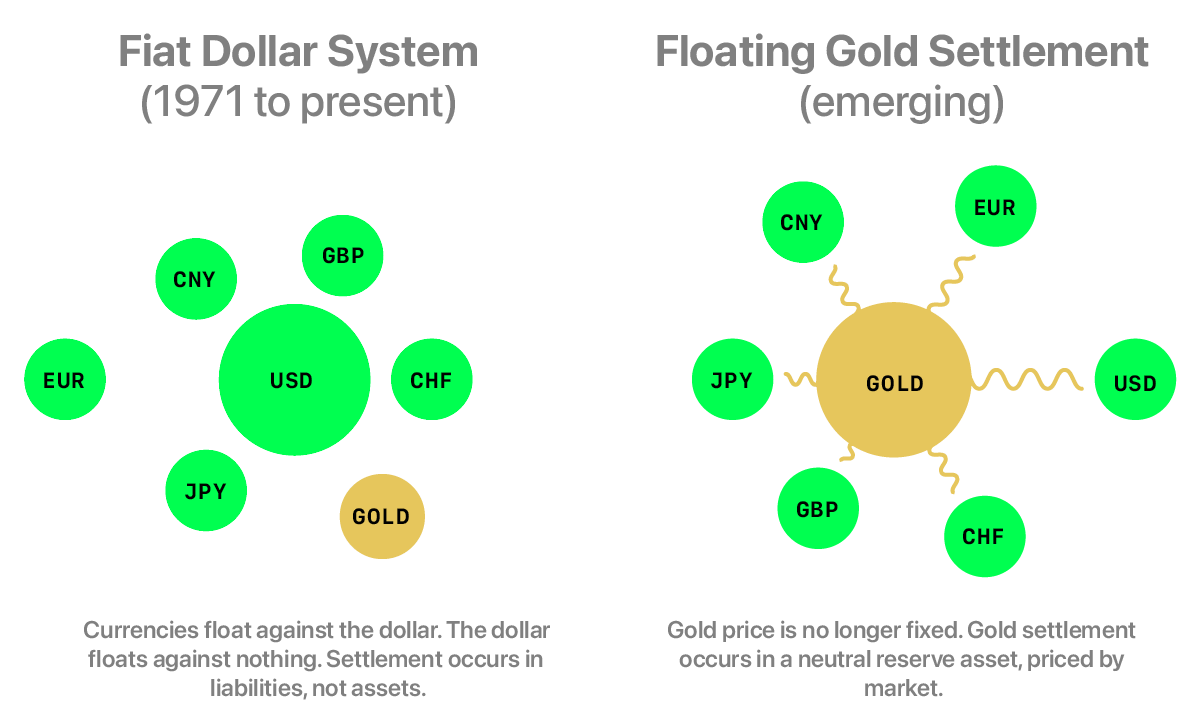

The Bretton Woods system had instability built into it. Foreign central banks could convert US dollars into gold at $35 per ounce. To maintain the system, the United States had to ship more and more gold overseas

That proved unsustainable. France demanded conversion of the dollars it held into gold. In response, President Richard Nixon went on television in 1971 and ended dollar convertibility. This is known as the Nixon Shock.

Jelle Zijlstra saw the Nixon Shock as a bad solution. A more stable outcome, he argued, would have been a sharp increase in the price of gold.

The United States rejected that option. Restoring gold to the centre of the system would have pushed the dollar into a secondary role and curtailed America's ability to pay for imports with dollars printed out of nothing. This would have reduced America’s standard of living.

Instead, the Nixon Shock fought to keep US debt and deficits at the core of global finance. The result was a monetary system that requires ever-increasing quantities of dollar debt to prevent collapse.

Let Gold Float

Jelle Zijlstra’s solution was simple: allow a much higher gold price to stabilize the system.

Europe took a step in this direction with the launch of the euro in 1999. The European Central Bank was the first to value its gold reserves at market prices, instead of a fixed price decided by government officials.

This corrected the core flaw. Under the classical gold standard, officials fixed the gold price by decree, so it was usually wrong. Under the new system, the gold market sets prices, so that as gold rises, reserve values rise with it.

China soon adopted the same approach. So did the international Basel III banking regulations, where gold held by central banks is now treated as a Tier 1 asset valued at market price.

This accounting 'trick' changes gold’s role in the global financial system. When gold prices were fixed, price increases did nothing for reserve balance sheets. When gold is marked to market, rising prices automatically expand reserves.

Governments with sufficient gold holdings and credibility can issue limited amounts of currency to acquire more gold. That buying pressure pushes prices higher and increases reserves both in volume and in value.

That process is now underway. Central banks are buying gold at levels not seen in decades. BRICS countries are repositioning gold closer to the centre of the global monetary system, not to replace the dollar, but to reduce reliance on U.S. government debt as the primary reserve asset.

The Incas did not think of gold as money. For them, it was sacred, a physical expression of the sun god Inti on Earth. Across thousands of years and cultures that shared little else, humans have kept faith in a shiny yellow metal with few industrial uses, other than storing value.

The future of money is weight.

Gold is a monetary anchor because of how it was formed and where it came from. Rare and extreme cosmic events produced a material that is scarce, inert, durable, and exceptionally hard to destroy. Like the solar system, monetary systems have never found a better anchor than mass concentrated in something real.

Gold is returning to the centre of the monetary system because everything else has been tried. Banknotes, bonds, tokens, leverage, derivatives. None of it holds, because like all promises, they are too easy to create.

Time for a reset.