Financial markets run on two emotions: fear and greed. When prices fall, people worry. When prices rise, they want more.

Gold hit new all-time highs last week, then dropped more than $300 Monday. Then it rebounded a bit.

Rising prices bring thank-you notes from Superbubble readers who bought early. Price drops bring questions about whether to hold, sell, or buy more.

No one can predict the future, so market volatility tests personality and character. Price swings force choices and measure responses to stress, uncertainty, and fear.

In 2016, I gave a talk in Portugal to some spiritual types. Their leader found my story plausible and straight afterwards, wired $200,000 to his local mint to buy one-ounce Krugerrands at under $1,200 each. Last week, the spot price hit $4,381 per troy ounce, making his haul worth about $746,000. A gain of almost 275%, followed by a ~7% drop.

Someone asked "Why dont I just buy virtual gold in an electronic form and then nobody has to get burgled?"

This note is about that.

Spot the Difference

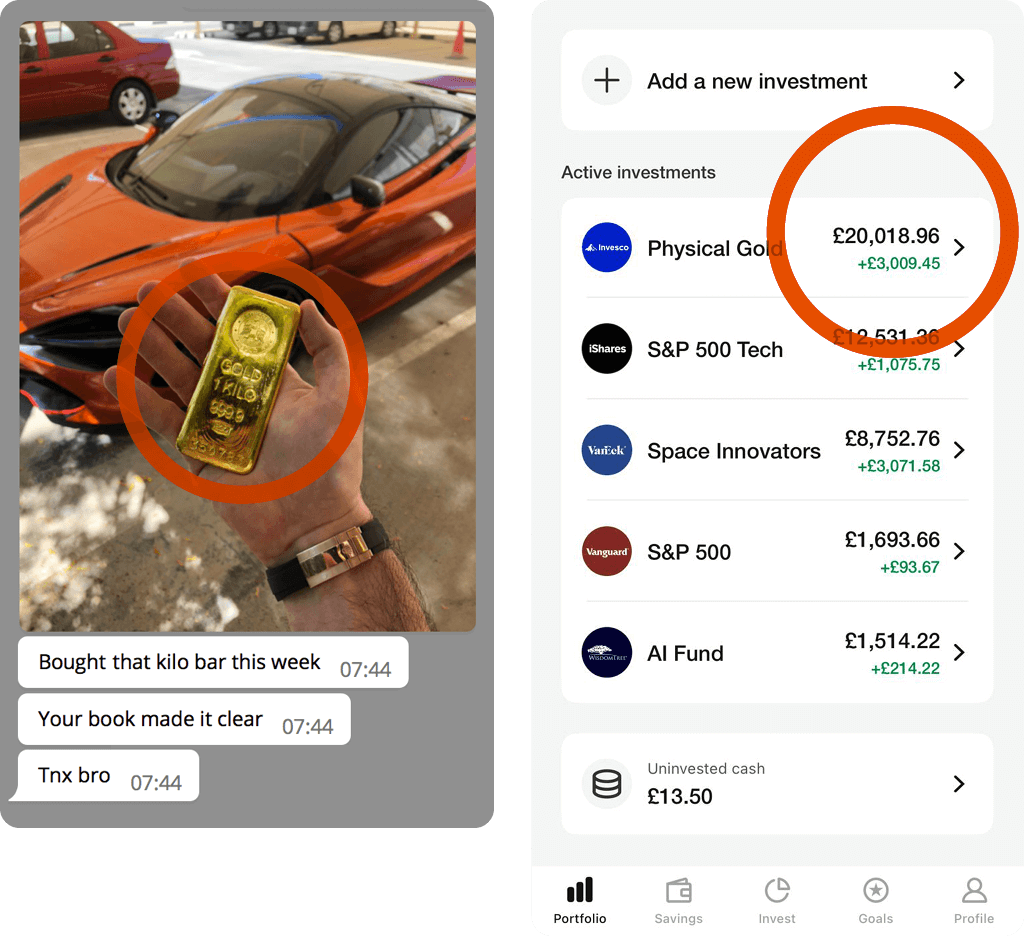

Here are two contrasting receipts that I got …

Both men spent five figures on 'gold', but the pictures show they own different things:

- The first image shows a hand gripping a one-kilo lump of yellow metal.

- The second shows a screenshot from a UK investing app.

It took a bit of digging to find out what the app user actually owns. He bought his 'gold' through a UK platform called Chip which offers a gold Exchange-Traded Commodity (ETC).

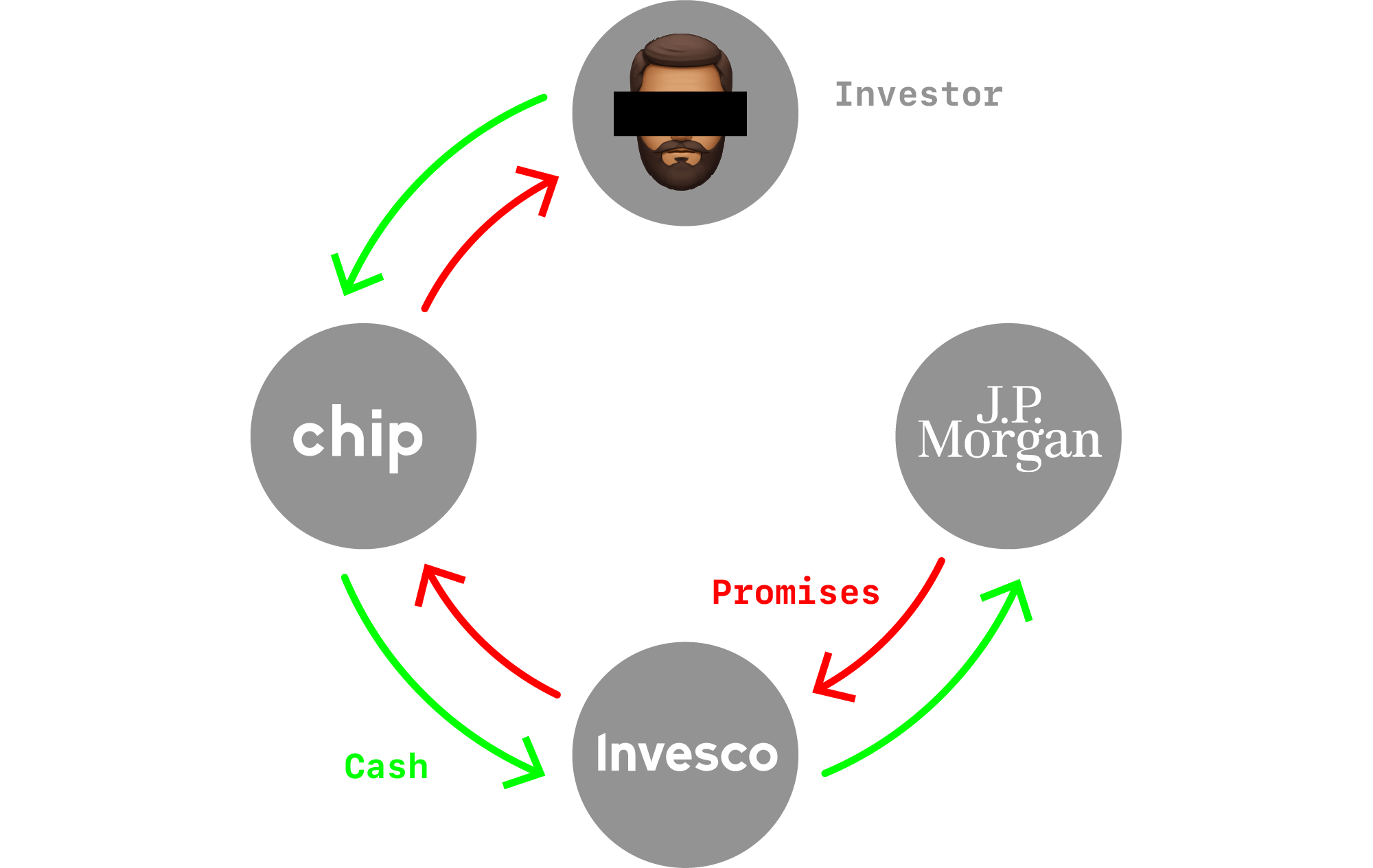

The Chip investor owns a debt certificate from Invesco, a global investment firm. The certificate is called the Invesco Physical Gold ETC and is issued by an Irish company.

Invesco promotes this instrument on the fact that it is one of the lowest cost ways to to store gold. That's because Invesco does not have the gold in question. Instead, custody sits with J.P. Morgan who holds the metal in London vaults.

J.P. Morgan also has a long record of fines and criminal cases for fraud, spoofing, and manipulating precious-metals markets. But fines don't matter to giant financial institutions, because a fine is a price — and fines are usually only a fraction of the profits made on a dodgy deal.

What the investor actually owns is a chain of obligations where each link depends on the next. He has no access to gold and no direct claim on metal. What he holds is a financial instrument tied to the price of gold, filtered through three institutions.

Every step adds risk. There is platform risk (Chip), issuer risk (Invesco), and custodian risk (J.P. Morgan). There is also legal-structure risk, since the ETC is something owed to the investor, not something he owns.

You can also add internet risk: Last Monday, Amazon Web Services (AWS) crashed, disrupting banks, payments and tech platforms all over the world.

Make Promises

The financial industry grows gargantuan by selling any kind of promise it can cook up: bonds, notes, derivatives, futures, forwards, ETFs, ETCs, options, structured products, SPACs, SAFEs, convertibles, perpetuals, stablecoins, staking yields. Stacked top of all this are endless layers of tokens, tranches, wrappers, and synthetics.

These are claims on future money — also known as promises. In short, you hand over money today in return for a promise of more money tomorrow.

Promises are much easier to make than they are to keep. The incentive is always to create more and hope people don't all ask for their money at once.

The gold market demonstrates this perfectly.

Physical gold is hard to find, mine, refine, mint, and store. But banks can create vast quantities of "screen gold" or "paper gold" through derivatives, ETFs, and futures contracts.

That’s how Big Finance turns real things into 'fairy dust' …

"It's not on the elemental chart. It's not fucking real" — from The Wolf of Wall Street

History shows the pattern: humans always make more promises than can be kept. Bubbles expand until they burst. Systems work until they don’t.

The dollar-based system still holds together. Kind of. Just about. For now. It works because key players are all-in, so pretend quadrillions in obligations can be met.

The illusion holds as long as confidence does. But confidence is weak glue. Crashes, hyperinflations, and manias are psychological events that follow predictable arcs:

Optimism → Greed → Mania → Loss of Confidence → Fear* → Panic → Contagion → Collapse

*You are here.

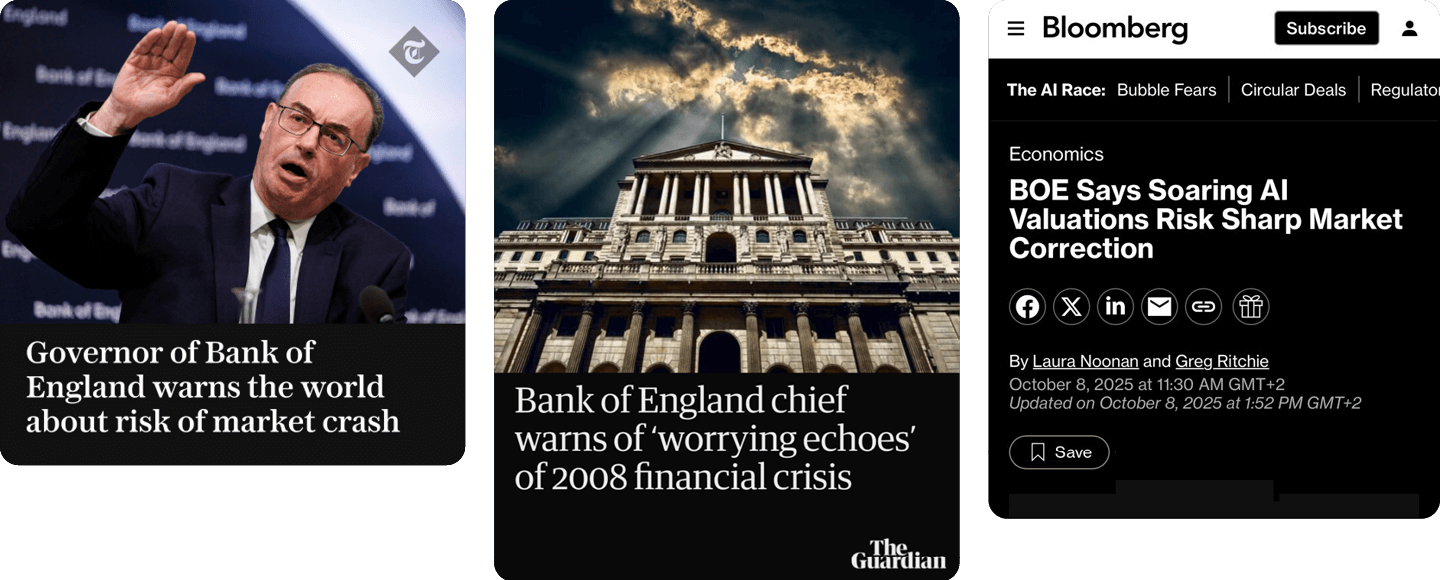

A rising, volatile gold price signals we are accelerating from fear into panic. As panic turns to contagion, bank runs begin. People rush to swap paper and digital tokens for something more real. Credit gets crunched and currencies die.

These are the rare, but extreme scenarios gold owners try to hedge against. Extremes are building: currency risk, geopolitical risk, systemic risk, counterparty risk, and growing financial instability.

Untrust London

Once, the City of London was the custodian of the world’s wealth, with the gold vaults under Threadneedle Street at the core of a banking empire.

Now that is unravelling. The institutions that built the global gold market cannot and will not keep their promises: Britain seized Venezuela’s gold. The UK government leads calls to seize Russian assets.

You may agree or disagree with those decisions. It doesn't matter. You cannot run a banking system where some people don't get their money back if the managers don't like them.

The new rules are clear: when it suits power, promises can be broken. It won't make much difference if you're a foreign autocrat or a citizen with some numbers on your phone.

London still clings to control of the gold market. Earlier this year JP Morgan and HSBC began pulling large quantities of bullion from the Bank of England and transporting it to the US.

When the next leg down comes, the London gold market may prove to be the financial system's great weak link.

Eventually, the price of gold will no longer be set — in secret — by a cabal of banks in London, but by the settlement of trade imbalances between the world’s superproducers of energy (Russia and the Middle East) and manufactured goods (China).

There are fewer reasons than ever to trust that London can look after anything but itself. Do not be caught out when confidence turns, and custodians must balance the books at any cost.

As London loses its grip on the gold market, the simplest response is also the oldest: hold some gold (even a small amount) outside the system, and forget the price on your screen.